Municipal Credit Perspectives — 2Q 2022

Persistent Pressures for Health Care Sector

The Health Care sector has served on the front lines of the pandemic without significant credit deterioration owing to healthy balance sheets at the start of 2020, along with substantial federal assistance in the form of direct grants, cash advances and higher levels of reimbursement. In the third year of the public health crisis, we are observing several headwinds that will pressure hospital margins for at least the next year or two. Spending growth is expected to outpace revenue expansion and squeeze margins, particularly during cycles of heightened case numbers. As one would expect, the hospitals best positioned to navigate these demands are high-quality systems with a broad geographic presence, solid operating histories, strong management teams and robust resources.

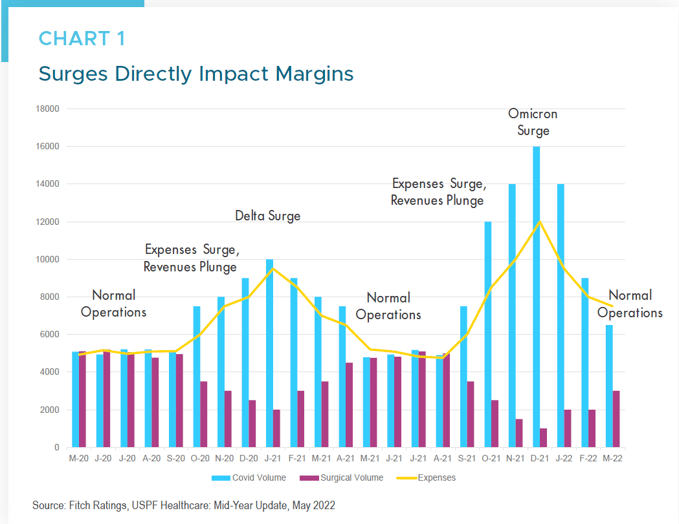

The year 2022 is proving to be a difficult one for our nation’s hospitals. The Omicron variant, which surfaced in late 2021 triggered a surge of Covid-19 cases and hospitalizations that stretched providers. Industry consultant Kaufman Hall reports the seven-day moving average of new cases hit an all-time high of more than 809,000 on January 15. As witnessed with both the Delta and Omicron variants, a spike in infections and hospitalizations generally translates into negative operating margins. Spending increases sharply to support greater volumes, while the displacement of higher-paying patient services leads to sub-optimal revenue growth. Although the Omicron surge subsided significantly by the end of March 2022, margins for the first six months of the year are projected to remain modestly negative across the universe.

Escalating spending pressures dominate current industry forecasts with a focus on labor costs, which represent on average 50% of system operating expenses. Although shortages exist across all staffing types, the deficiency is most acute among experienced nurses. Common contributors to the shortfall include burnout, early retirement and high turnover, yet the shift of many employees to significantly higher-paying roles as traveling “contract” nurses is also a factor. Although the reliance on temporary staffing has eased along with the hourly wages earned, according to a recent study by Kaufman Hall, median labor expenses through March 2022 increased by more than 33% from 2019 levels. Sector participants expect these expenses will remain elevated for the next few years, until a variety of strategies are implemented to remedy the imbalance. Additional burdens on spending include inflation-induced price increases for supplies and pharmaceuticals, as well as continued supply-chain disruptions.

The revenue side of the operating ledger is experiencing challenges as well. The extraordinary government assistance distributed during the past two years is winding down, with little appetite for additional authorizations. Federal reimbursement levels under the Medicare and Medicaid programs are unlikely to keep pace with expense growth. Negotiations with commercial insurers are expected to produce similarly disappointing results.

In its recent mid-year update, S&P estimates most hospital bond ratings will remain unchanged in 2022, but by year-end, negative rating actions will outnumber upgrades. Through May 2022, S&P reported an equal number of upgrades and downgrades (nine each) but found the downgrades to be clustered at the lower end of the rating scale, demonstrating the limited options available to weaker systems in responding to tighter operating margins.

We believe high-quality names with a broad market presence, sound operating histories, capable management teams, and healthy balance sheets will be best positioned to navigate upcoming fiscal pressures. Our intermediate composite exposure to the Health Care sector consists of 67 issuers with a median bond rating in the AA-range by Moody’s and S&P. Broadly, these issuers are large systems, that offer an array of services and specialties through an integrated platform and benefit from economies of scale, including the ability to negotiate more favorably with labor and insurance providers. We are comfortable in our ability to monitor ongoing developments in our portfolio since quarterly reporting is an industry standard. As always, we will continue to review sector developments to sidestep potential pitfalls, as well as uncover value opportunities.