Municipal Credit Perspectives

State of the States 2024: Elevated Reserves Cushion Revenue Slowdown

Following two years of extraordinary performance driven by the unique circumstances of the global pandemic, fiscal conditions for the state sector appear to be returning to more normalized levels. Despite muted revenue growth in fiscal 2023, operating results were sound, thanks in part to cautious forecasts. Although budget officers anticipate lower revenues in 2024, significant reserves amassed in recent years should buffer against any negative surprises.

In its annual Fiscal Survey of States, the National Association of State Budget Officers (NASBO) reviews the recent and prospective performance of the sector’s primary discretionary operating fund, known as the General Fund. The primary revenue resources for state General Funds include personal income taxes, sales taxes, and corporate income taxes, while the largest expenditures in a typical year are Medicaid and K-12 education assistance.

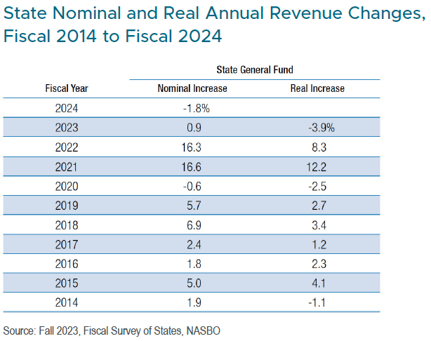

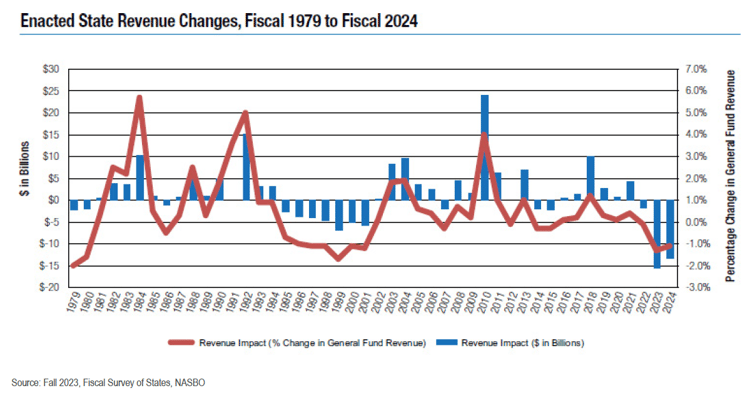

Following two consecutive years of double-digit gains, General Fund revenues stalled in fiscal year 2023, posting modest growth of 0.9%. Even with the dramatic deceleration of inflows, revenue collections outpaced original estimates by 7.7% and 47 states reported tax collections above forecast. Recall, most 2023 budgets were drafted during the spring of 2022 (for a July 1 fiscal year start) when market indicators were pointing to a recession. Similarly, the spending plans for fiscal 2024 anticipate further slippage, calling for an annual revenue decline of 1.8% to $1.18 trillion in total collections. The weaker revenue picture reflects not only the inevitable retreat from historic highs, but negative investment returns in calendar 2022, slowing consumption, lower corporate profits, and widespread tax policy changes.

It is important to note that 37 states enacted tax cuts for fiscal 2024, while only 3 states adopted tax increases. Although the net impact of $13.1 billion of lost revenue in 2024 is relatively minor (and for some issuers, temporary), the tax relief efforts signal confidence in the sector’s overall fiscal stability.

Traditional discretionary state spending was upended following the global health crisis as expenditure growth ballooned to facilitate temporary relief programs financed through unprecedented levels of federal aid. Elevated spending continued in 2023 with aggregate expenses totaling $1.19 billion or 11.8% above the prior year. Much of the budget expansion can be linked to nonrecurring measures, as many states witnessed better-than-expected revenue collections at mid-year and subsequently authorized additional outlays. For the current year, General Fund spending is expected to rise 6.5% to $1.26 trillion, driven by higher spending among 34 states. While there are multiple financial pressures across the sector, a common stress point for the peer group is compensation increases tied to tight labor markets, causing 40 states to enact universal pay raises with a median wage hike of 5.0%.

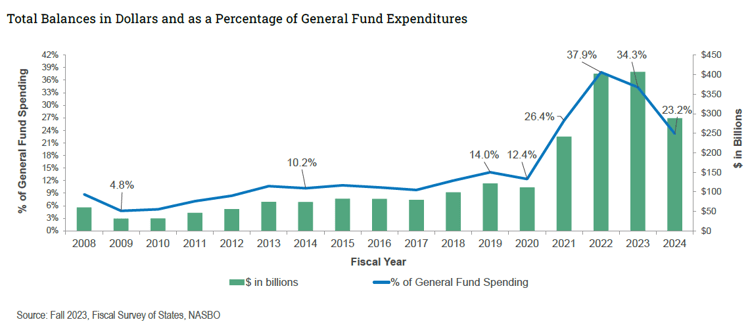

Throughout the extraordinary operating environment of recent years, policy makers remain committed to the maintenance of robust reserve levels. Total balances, which include both “rainy day” reserves and ending General Fund balances peaked in fiscal 2022 at $402.1 billion or nearly 38% of spending. Although many states will continue to draw upon a portion of these monies, the group is expected to close 2024 with available cash of nearly $290 billion representing a lofty 23.2% of expenses, well above pre-pandemic levels.

Although the peak of this unique credit cycle has passed, we remain encouraged by the prudent allocation of windfall collections and the accumulation of healthy reserves. We currently own 36 different states including higher-yielding names such as New Jersey and Illinois. Conservative budget practices are expected to continue as officials navigate the various challenges of a slowing economy, wage pressures and developing service demands. We are confident our issuers will successfully manage the evolving operating landscape and we affirm our stable outlook for the sector.

Published January 2024