Municipal Tax-Equivalent Yields Rival Riskier Asset Classes — November 2022

The sharp rise in tax-exempt yields over 2022 has created a much more attractive entry point for municipal investors. As of October 31, the yield on the Bloomberg Municipal Bond 10-Year Index was 3.95%, its highest point in over a decade. If we restate that level using a tax-equivalent yield, we can see how favorably municipals compare against other, riskier asset classes.

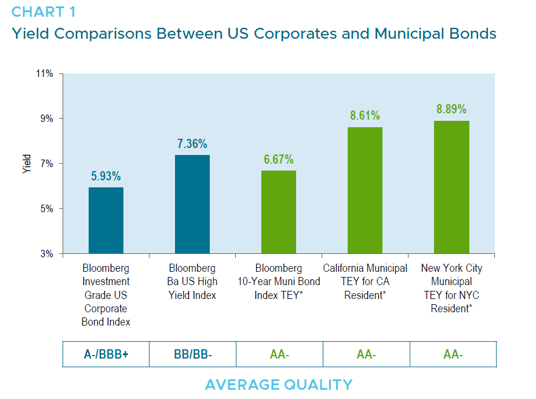

Chart 1 compares the tax-equivalent yields for an investor in the highest marginal tax bracket (37.0% federal + 3.8% health care surtax) across two major fixed income asset classes: US corporates and municipal bonds.

Municipal bonds can offer a similar tax-equivalent yield to taxable alternatives, only municipal bonds come with higher credit quality and lower historical default risk — favorable characteristics as we move deeper into a global tightening cycle. Based on S&P data, the average US public finance default rate during the global financial crisis in 2008 and 2009 was 0.02% versus 4.28% for US Corporates.

As of October 31, 2022

Sources: Municipal Market Data, Bloomberg Barclays indices, and GW&K Investment Management *Tax-equivalent yield (TEY) calculated using the highest income tax bracket (37.0%), health care surtax (3.8%), California tax (13.3%), and New York City tax (14.78%). The tax-equivalent yields for California and New York City municipals were approximated by dividing the yield of the Bloomberg 10-year Muni Bond Index by (1-tax rate) for residents.

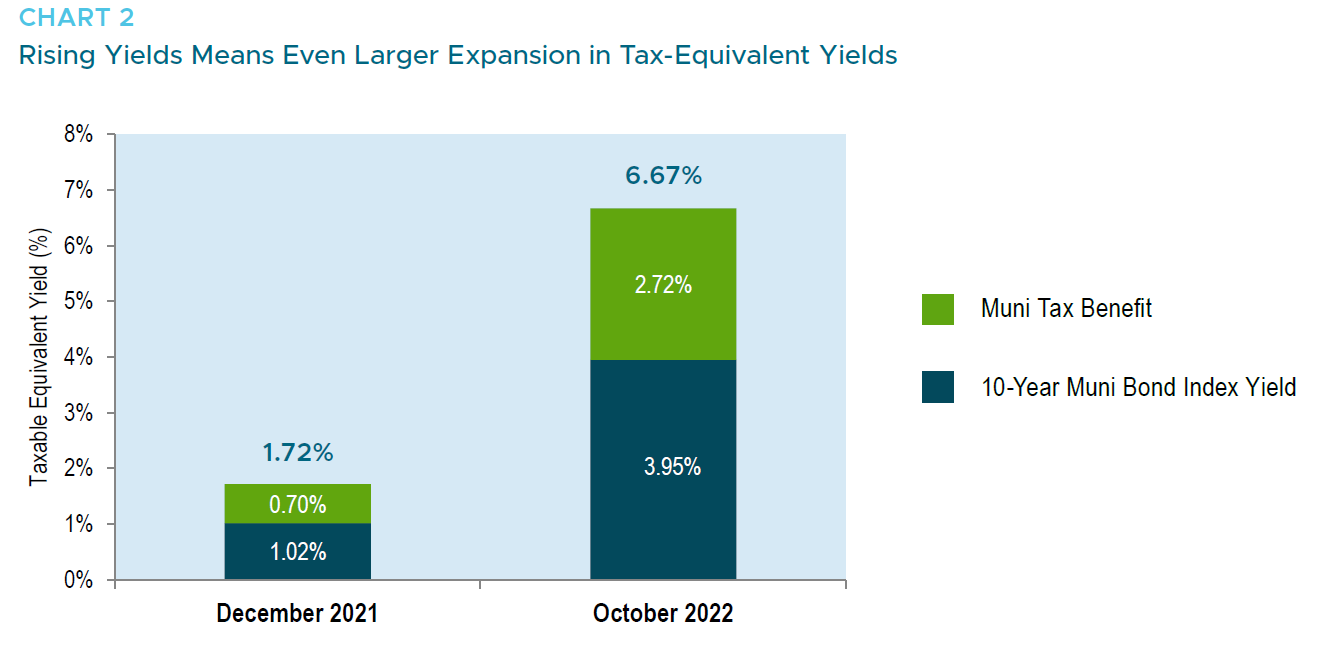

In Chart 2, you can see that the change in yields for the municipal market this year has meant an even larger expansion in tax-equivalent yields. In fact, for every 25 basis points in absolute municipal yields, the tax-equivalent yield increases by 42 basis points, making municipal yields that much more attractive for individual investors in the highest tax bracket.

In a market dominated by retail investors, absolute and tax-equivalent yields can drive decision making, as interest tends to grow when certain thresholds are met and crossed. In today’s environment, this shift in sentiment may first require some stabilization in the broader market, but at some point, we expect these levels will elicit considerable demand as an attractive entry point.

As of October 31, 2022

Sources: Municipal Market Data, Bloomberg Indices, and GW&K Investment Management