What's Next for the Energy Sector?

As countries around the world work to achieve net zero goals to dampen the effects of climate change, the Energy sector is experiencing a seismic shift. Geopolitical tensions, most recently Russia’s invasion of Ukraine and the subsequent work by European economies to wean themselves from being dependent on Russian energy, have caused more immediate concerns about energy costs and availability. Countries have massively underinvested in energy over the past 15+ years, which could soon end a long period of energy abundance and put us on a path to energy scarcity globally. As energy prices have risen along with the risk of a recession, we asked two of our Energy experts, analysts Maya Mirson-Tohme and Jim Tschudy, and our Global Strategist William Sterling, to share some of their deep knowledge on the sector.

In conversations with clients, we're talking more about energy than we have in the past 6+ years. What are the most important aspects to understand about the energy sector today?

Maya: While there are many forces contributing to the current energy crisis, underinvestment in both fossil fuels and clean energy is a key driver of the supply constraints challenging the market today. Many countries desperately need to secure energy, but are also mindful of their energy transition goals. This is driving some policymakers to fast-track clean energy initiatives as the need for alternative and reliable energy sources becomes even more apparent.

Government policy changes in many countries aim to address supply constraints and energy price inflation in the near term. There are some concerns around demand destruction if we do enter a prolonged recession, and China’s rapidly changing Covid policies still drive volatility in commodity prices. But ultimately, tight supply is supporting energy market fundamentals and right now there is not a lot of incentive for oil and gas producers to increase production.

Narrowing in on the credit market, fundamentals within the Energy sector remain quite strong. This is driven by sustained capital discipline from oil and gas companies. Producers are no longer focused on investing in growth — a departure from their historical mindset. Now they are focused on maintaining lower levels of production, expanding free cash flow, strengthening their balance sheets, and returning cash to shareholders. They’ve stuck to this discipline since the early months of the pandemic, when the price of oil dropped below $0 per barrel, and ultimately that’s been supportive of fundamentals on the credit side.

The energy landscape and investable universe is changing, specifically on the credit side where we’ve seen substantial migration of debt from the high-yield index to the investment-grade index because of that financial discipline and balance sheet strength. We’ve also seen a lot of consolidation in the industry over the past couple of years as companies no longer seek to invest in organic production growth, but look to acquire assets to grow their production base.

The sector has performed well over the past couple of years, and there is still opportunity there as many other industries see a far greater impact from inflation, interest rates, and recessionary concerns. Even with elevated commodity price volatility, these companies are generating substantial free cash flow and they are managing their balance sheets with the commodity cycle in mind.

Jim: A host of factors could potentially cause this to be a much longer supply response than we’ve seen in the past, including the impact of environmental, social, and corporate governance (ESG) measures and the pressure to reduce emissions. Longer term, there are also questions about what demand ultimately will look like for oil and other fossil fuels as we transition toward more renewables.

Every component of energy supply — from oil, to natural gas, to refining capacity, is supply constrained — and we’re seeing that in prices currently. We’ve gone from a period of energy abundance over the last 10 years, where markets were oversupplied with oil and companies were underinvesting in development, to entering a period where OPEC spare capacity levels are back to lows we haven’t seen since 2006. Russia was the largest exporter of natural gas, crude oil, and oil products, so a prolonged lack of access will have a significant impact on future supply and demand balances. Oil and gas development capital expenditure is back to 2006 – 2008 levels, but per unit of oil and gas consumed, real capital expenditure is still 20% below those levels.

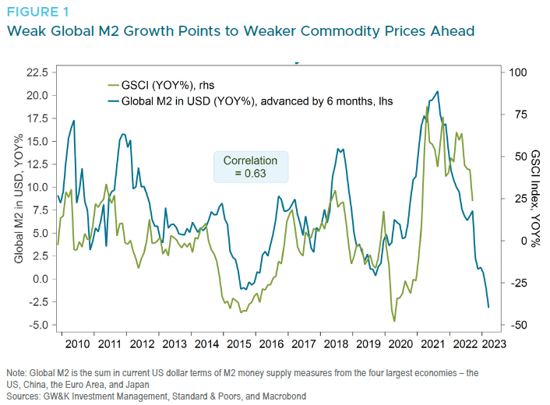

Bill: We are living through a durable supply shock now, with the change in access to Russian oil and gas. This shock has contributed to a monetary policy that has become so extreme that Bloomberg’s survey of economists puts 65% odds on a recession in the US and 80% and 90% respectively for eurozone and UK recessions. Tight monetary policy tends to lead to lower commodity prices, as illustrated in Figure 1.

If we do have a recession, that may constrain the near-term price of oil. But this recession risk is an overlay on top of an energy supply picture that is about as tight as we’ve ever seen it: excess energy capacity as a percent of total energy demand is very low, around 2%, which historically has been associated with very tight markets for multi-year periods.

Why has the energy sector had such a prolonged period of underinvestment?

Jim: In addition to being oversupplied with oil over the past decade or so, markets also came to view US shale oil as a large installed base of spare capacity that could increase supply as needed. Overall spending has been below where the market needs to be just to stay flat. What typically happens during prolonged periods of underinvestment is companies and governments end up whittling down spare capacity to the point where the market becomes extremely tight, which, as Bill mentioned, is where we are heading now.

Maya: Oil and gas producing companies were just not rewarded for growth historically. Investors and boards are pushing for more capital discipline and higher shareholder returns — not production growth. Years of overinvestment resulted in serious implications for these companies during periods of pronounced commodity price volatility. Prompted by the demand shock at the onset of the pandemic, global oil majors have adopted a more intentional supply management strategy as a means to maintain elevated price levels in support of margins. There may be some incremental pressure from an increased focus on ESG investing and decarbonization goals, but history has taught management teams that they aren’t going to be rewarded by investors for growing production.

Jim: The transition from fossil fuels to renewable energy sources will likely be measured in decades, not years. One very sobering statistic I read recently is that over the 10-year period from 2011 – 2021, a $3.8 trillion dollar investment in renewables moved fossil fuels just 1% less — from 82% to 81% — of overall energy consumption.*

Renewable sources as a percentage of energy consumption are led by Europe at 13% (Germany is at 18%), versus the OECD average of 9%, and non-OECD at 5%. The current European energy crisis has led to calls for accelerated investments, as has the Inflation Reduction Act in the US.

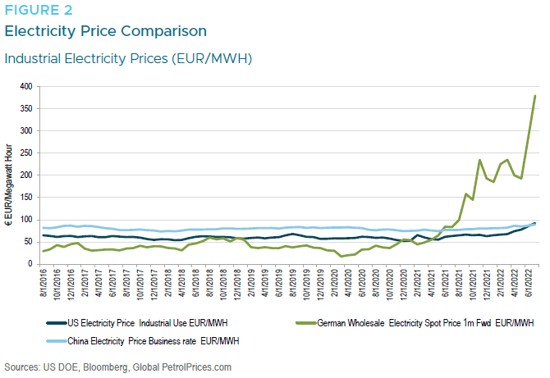

Europe has transitioned quickly to renewables, which has led to intermittency issues even prior to the Ukraine invasion and the end of cheap natural gas from Russia. This ultimately threatens their industrial sector. The prices of natural gas in Europe, and as a result, power prices, are starting to cause other trade deficit blowouts. Some firms that have been in business in Europe for over a century are declaring bankruptcy, or leaving Europe, partly due to the high cost of energy. The world’s largest chemical company, BASF — founded in Germany in 1865 — has permanently shrunk its European footprint, citing the high cost of energy and increased regulation as reasons the company will now expand in China.

Figure 2 shows an electricity price comparison for China, Germany, and the US, and you can see that Germany has gone from a distinct advantage to a distinct disadvantage. Prior to 2021, German industrial electricity prices traded at an average discount of 40% relative to China and the US. Those prices peaked last summer at over 7 times those of the China and the US. Even though prices have fallen in Germany now due to a warmer than normal winter, they remain roughly double pre-2021 levels.

*From Energy Analyst Jeff Currie at Goldman Sachs

China is clearly making inroads in terms of transitioning to renewables — they have the highest penetration rates of electric vehicles globally. They’re investing in wind and solar, and they dominate those supply chains. They also have more than 100 nuclear plants, which have been a key part of their strategy for more than 10 years. Yet they are still increasing coal production by 300 million tons over the next three years, because their low cost of electricity — largely generated from relatively inexpensive coal — is a key competitive advantage. During the Chinese Communist Party Congress in October, President Xi Jinping reiterated that the country, “must establish the new before we demolish the old” regarding China’s energy sources.

Increased demand for electric vehicles and investment in solar and wind is pressuring raw material and supply chains and reversing cost declines. While electric vehicle penetration could see oil demand peak by the end of this decade, currently the market share of sport utility vehicles has increased, boosting oil demand and offsetting the impact from electric vehicles. And Norway presents an interesting test case: electric vehicle sales have already reached over 60% of total car sales, however oil demand in 2022 was actually higher than it was in 2016.

Renewables run at much lower rates of capacity utilization, and solar and wind power are energy intensive to produce. The solar value chain starts with polysilicon and wind turbines are primarily made of fiberglass. Both materials are energy intensive to produce and concentrated in China. To quote Rob West, founder of the energy research consultancy Thunder Said Energy, “There are bottlenecks in the energy transition: energy shortages, material shortages, infrastructure shortages. And what we need to do is decarbonize the world and debottleneck these bottlenecks along the way, otherwise the prices of some of these things will go to the moon.”

Maya: It’s estimated that we need about $3 to $5 trillion in clean energy investment per year to achieve global climate goals and we are currently on track to reach $2 trillion per year by 2030. As Jim said, development of clean energy technologies requires fossil fuels, and as oil and gas prices increase, the cost to develop these necessary technologies also increases. Historically there’s been a mismatch between policymakers’ pursuit of net zero carbon goals and the actual pace of economies shifting away from fossil fuel consumption.

There’s also potential for higher inflation and recessionary pressures to impact the pace of clean energy adoption at the consumer level. If we don’t continue to invest in fossil fuels, investment in clean energy becomes even more costly and challenging, especially in emerging economies where the cost of clean energy is much higher than traditional sources.

What does the future hold for the energy sector?

Jim: We likely won’t see a peak in oil demand until the mid-2030s. Natural gas usage could triple over the next 20 – 25 years or so, as the world tries to aggressively reduce our dependency on coal because natural gas is 50% less carbon intensive than coal. There are also concerns about recessionary risks — the impact from the high prices of energy is clearly a big concern. If we go into recession, that will dent demand in the short run.

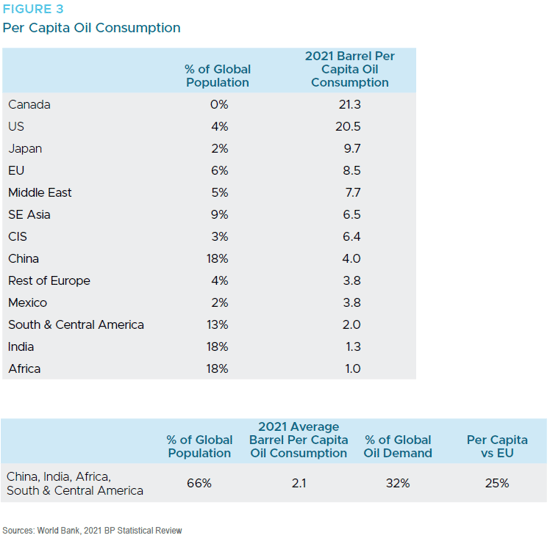

Higher living standards and population growth in parts of the world that are currently energy poor will also have a huge impact on the sector, potentially creating a longer-term tailwind from an oil consumption perspective. Currently China, India, and Africa — over 60% of the world’s population — have a per capita consumption of less than four barrels of oil per year, compared to Western Europe right around 10, and the US at 21 (Figure 3). Rapid consumption growth in the emerging world is not being offset by flat or declining consumption in the developed world. The Energy sector is currently valued at around $7 trillion, and the International Energy Association expects growth of more than 30% by 2035.

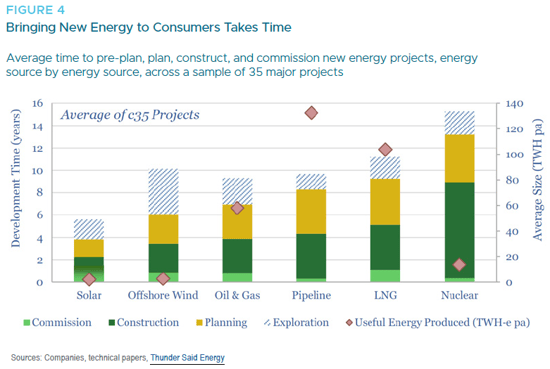

Nearer term, I think it’s important to remember that because of the underinvestment we’ve seen in the sector, it generally takes a long time to bring on new sources of energy, as we can see in Figure 4.

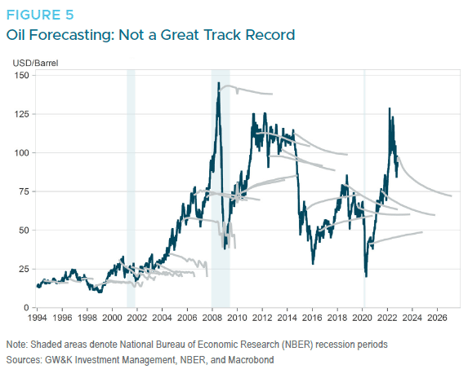

Bill: In terms of oil prices, the futures markets have not provided reliable forecasts (Figure 5). In a 2011 report, US Federal Reserve researchers tried to determine if there were gains to be had with oil-price forecasting in terms of accuracy, compared with conventional, “no-change forecasts,” which take today’s price and assume it’s going to be the same a year or two from now. What they discovered was that the no-change forecasts resulted in fewer big errors than any other forecasting technique they tried. Politics, technology, and regulation are just a few of the factors that make it really difficult to predict oil prices — or what the future of energy will look like, for that matter. It’s possible that we develop a means of harnessing energy from thermonuclear fusion, for example, which would be a game changer as a clean, affordable, and sustainable source of energy.

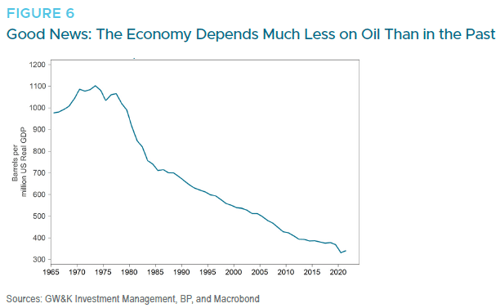

One piece of good news is the economy depends much less on oil than it did in the past. Figure 6 shows barrels used per million US dollars of real GDP. We’re much more efficient with the way we use oil — for example, gas cars are much more efficient than they were previously — resulting in a three-quarters drop in the amount of oil used per unit of real GDP than we had in the mid-1970s.

Maya: From a credit perspective, the sector is more durable now than it has been in the past. There’s been more volatility in the sentiment surrounding the energy markets than in the actual fundamentals of the sector. There are still areas of opportunity for continued deleveraging and credit improvement in the Energy sector, and it currently provides somewhat of an offset to the macroeconomic challenges impacting other industries.

We apply an overarching ESG view to all industries within the Energy sector, but there are some companies that are further along in their ESG efforts than others. We closely monitor progress at the company level, but also recognize that there could be headwinds in the future with policy changes, which drives our view of ESG at the sector level.

Energy companies from across the sector are expanding their focus on sustainable infrastructure and committing capital to developing decarbonization technologies like carbon capture utilization and storage, direct air capture, and renewable fuels pipeline transportation. We’re still very early on in the development of some of these technologies but as energy companies are focusing less capital on production growth, yet continuing to generate tremendous cash flows, they can deploy more capital to sustainable investments — and we are already seeing some do so.