Cash Is Not Always King

As interest rates have risen from the latest Fed tightening cycle, many investors have elected to seek shelter from the volatility by investing in short-term vehicles like money market funds or T-bills. While it might appear tactically attractive, investors open themselves up to new risks by using short-term investments as a core part of their fixed income allocation.

Not only does favoring short-term investments like money markets or T-bills open investors up to significant reinvestment risk, but this strategy also historically underperforms when compared to owning intermediate municipal and taxable bonds after the peak of Fed tightening cycles.

Municipal Bonds

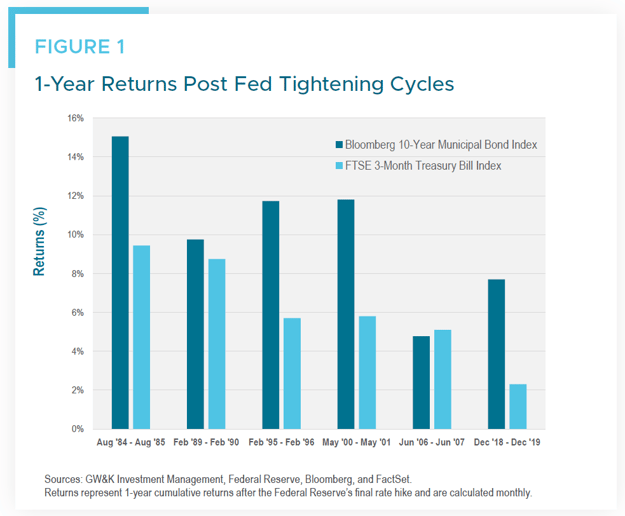

Using the Bloomberg 10-Year Municipal Bond Index as a benchmark, Figure 1 shows how it played out for municipal bond investors:

When compared to short-term instruments, intermediate municipals have outperformed in all but one of the years following the last six Fed tightening cycles. When you consider the added tax benefits, municipals outperformed quite handily, and the results were not particularly close.

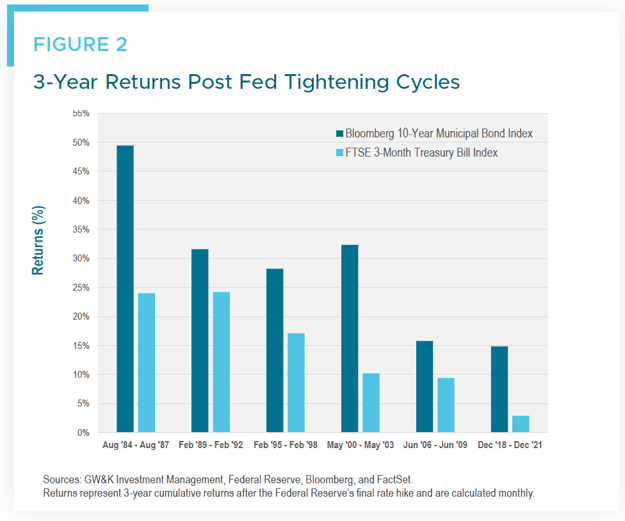

As it relates to the three years following Fed tightening cycles, the risk of moving to cash is further magnified. Municipals cumulatively outperformed cash alternatives by approximately 14% on average (Figure 2).

Taxable Bonds

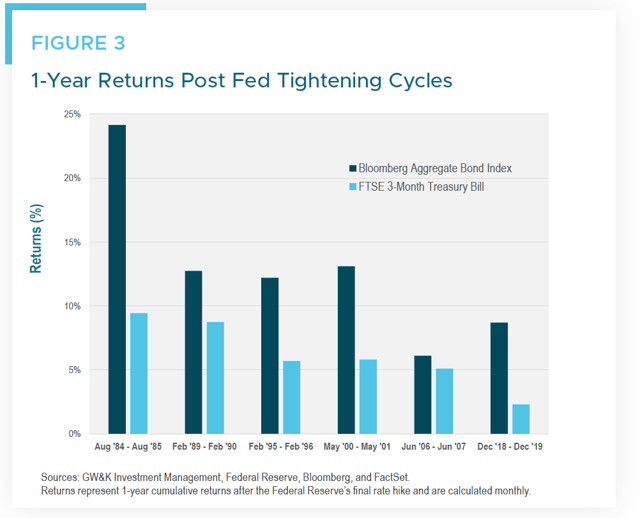

Now, looking at the Bloomberg Aggregate Bond Index as a proxy for taxable bonds (Figure 3), the story is quite similar:

In the 12 months following each of the previous six Fed tightening cycles, the Index outperformed cash alternatives by more than 6% on average.

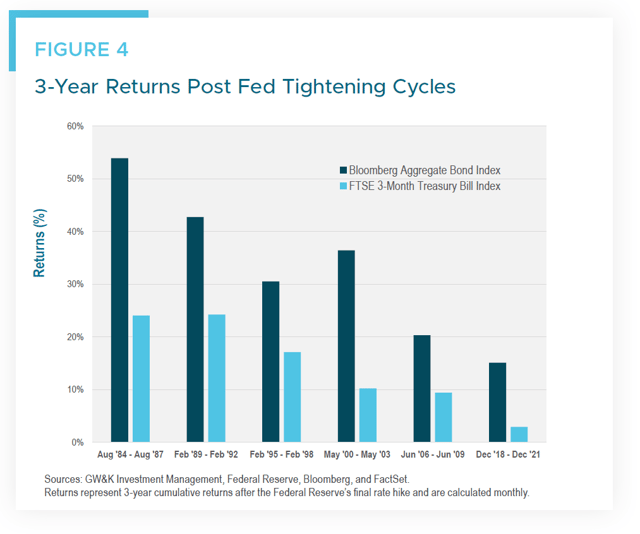

As for three years following a Fed tightening cycle, the strategy of adding duration and forgoing cash alternatives paid off in spades, with the Index outperforming cash alternatives by more than 18% on average (Figure 4).

Volatility In Money Markets

Conventional wisdom suggests that money market funds generally exhibit minimal to no volatility. However, when a Fed tightening cycle turns into a Fed cutting cycle, money market funds are impacted materially.

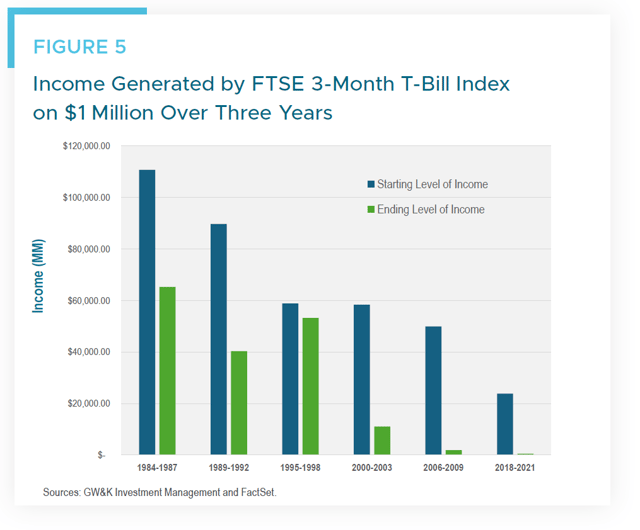

Using the FTSE 3-Month T-Bill Index as a representation for money market funds, looking at the three years following the previous six Fed tightening cycles, the income generated by money market funds was 63% lower on average. Even with eliminating the Great Financial Crisis and the Covid-19 pandemic — during which, the Fed essentially cut its target rate to 0% — the income generated was still 46% lower on average (Figure 5).

In Conclusion

Moving to cash in the face of increased volatility in fixed income markets and a Fed tightening cycle might feel like the right thing to do, but historically it has not been a winning strategy. A consultation with an active bond manager may be beneficial for investors who have questions about their fixed income allocations.

Follow the links to learn more about GW&K’s expertise in municipal and taxable bond management.