Opportunities in Preferred Securities

Taxable Portfolio Manager Stephen Repoff shares his perspective on the perpetual preferred market, including his latest thoughts on the outlook for the sector, the role preferreds can play in a diversified portfolio, and how GW&K approaches this unique segment of the fixed income market. He also explains some advantages of preferred securities he believes investors should consider.

Q: First off, can you provide some background on perpetual preferreds?

Stephen Repoff: Perpetual preferreds are securities that are effectively a hybrid of bonds and stocks. They make regular cash payments and trade on a par basis like traditional fixed income instruments, and they have no final maturity and can remain outstanding indefinitely like stocks. They also tend to be issued by companies that are tightly regulated, well capitalized, and in traditionally stable industries, like banking, insurance, and utilities.

Preferreds pay coupons that are either “fixed-for-life” or fixed for a given period of time (typically five years) before they begin resetting periodically thereafter; these are called “fixed-to-float” or “fixed-to-fixed,” depending on the frequency of their reset cadence. These different features create a variety of unique risk-factor exposures and return profiles. Preferreds are also redeemable by the issuer at par after several years.

Q: You mention regular cash payments – can you speak to preferreds' expected returns?

Stephen: Preferred yields tend to be several percentage points higher than Treasury rates, offering a “spread” to compensate for credit risk. Preferred issuers tend to be highly rated (i.e., the companies themselves are investment grade), but because the preferreds are subordinate to senior debt, their ratings are notched lower and their spreads are commensurately higher.

Additionally, the perpetual nature of preferreds tends to result in more volatile price movements, so investors typically demand a greater risk premium for this uncertainty. Depending on the market environment and investor tolerance for credit risk and volatility, preferreds can trade at a meaningful discount to par and thereby offer potential for price appreciation.

Q: Why should investors consider investing in preferreds today?

Stephen: The primary advantage preferreds offer is their yield, particularly in light of the high credit quality of the largest issuers in the space. As of December 31, 2023, the yield to worst* of the ICE BofA Fixed Rate Preferred Index was 6.33%, with the fixed-to-float component carrying a YTW of 6.91%. This is a spread of 227 basis points above Treasuries for investment-grade securities. This high credit quality reduces the risk of default and limits volatility in an uncertain macroeconomic environment.

Variable-rate preferreds are particularly compelling during periods of heightened interest rate uncertainty. Typically, bond prices decline when interest rates rise, but preferreds are less sensitive to this factor because their rates reset every few years. As part of a broader portfolio, preferreds offer an appealing alternative to equities and high yield debt.

Q: What does GW&K's active management style offer in the space?

Stephen: Looking at fundamentals, our bottom-up research process informs our decision to hold each preferred in the portfolio. We analyze credit metrics, governance, asset quality, and revenue diversification. This process has driven our decision to maintain an up-in-quality bias among financials and avoid banks with less robust balance sheets, in keeping with our aim of limiting volatility and preserving principal.

We perform scenario analyses and stress tests on each of our holdings to identify risks and opportunities, which offer advantages from a valuation perspective. The results of these exercises inform our assessment of yields and the broader construction of the portfolio to optimize for risk-adjusted returns across a variety of potential outcomes.

From a technical standpoint, there are many factors that drive price movements in preferreds beyond interest rates and credit spreads. New issuance trends, rate volatility, and the likelihood of redemption can all have a meaningful influence on risk/return profiles. These complexities create an opportunity for active managers like GW&K, since we closely monitor them and actively seek to exploit dislocations that result.

Q: What else do you think investors should know about investing in preferreds?

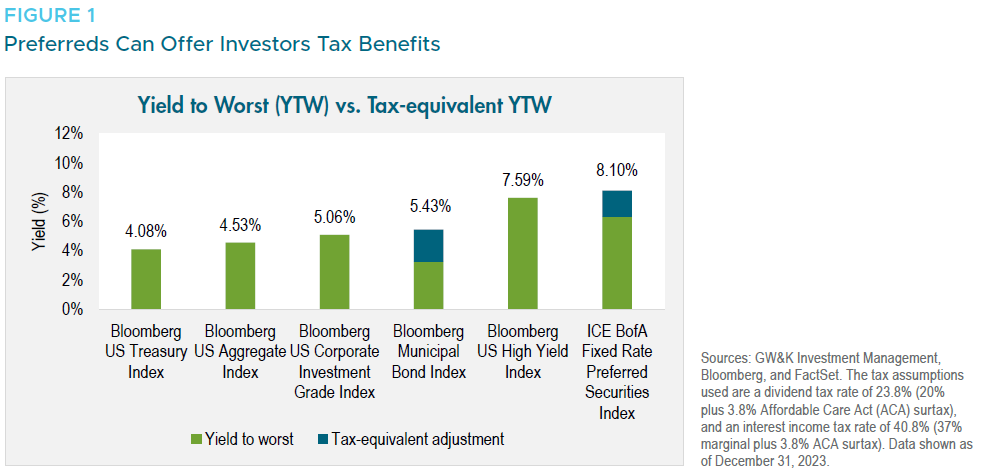

Stephen: The majority of the preferred market, and 100% of the holdings in our Strategy, pay dividends that are treated as qualified dividend income (QDI). This means that payments are taxed at the lower long-term capital gains rate of 20%, rather than at the ordinary-income rate like traditional bonds. This means a preferred with a 6.3% yield offers a taxable equivalent yield of approximately 8.1% (Figure 1).

*Yield to worst (YTW) is the yield calculated to the effective maturity data. It is the lowest possible yield an investor can expect, absent a default, expressed as an annual rate.