What's Next for Securitized Assets Amid the Recent Banking Turmoil?

April 2023

The nearly $18 trillion securitized assets market started 2023 strong, but rising interest rates and concerns about US banks have recently weakened this sector of the fixed income market. What’s next? We spoke with GW&K’s Senior Securitized Analyst Brendan Doucette to get his take.

Q: Why were securitized assets part of the recent banking turmoil?

Brendan Doucette: Along with making loans, banks often invest in high-quality, liquid assets that can easily be sold or borrowed against in the capital markets. Treasuries are the most liquid assets; however, banks prefer the additional spread offered by agency mortgage-backed securities (MBS), agency commercial mortgage-backed securities (CMBS), and other high-quality spread products.

Unlike other banking crises, the recent turmoil was caused by rising interest rates and the mismanagement of interest-rate risk — not from the credit quality of the underlying assets in the failed banks’ portfolios. The sharp increase in interest rates caused a decline in the value of the banks’ MBS portfolios, exacerbating the mismatch between the banks’ assets and liabilities.

Q: Which of the securitized subsectors were most impacted, and what's the near-term outlook for those assets?

Brendan: Given banks’ preference for high-quality liquid assets, the most impacted subsectors were the agency mortgage-backed securities (MBS) and agency commercial mortgage-backed securities (CMBS) sectors. The FDIC is now in control of more than $100 billion in assets in these sectors on behalf of the failed institutions. They’ve hired a manager to liquidate these assets in an orderly manner throughout the remainder of the year.

The securities book at Silicon Valley Bank increased dramatically in 2020 – 2021 as the bank’s deposits grew. Banks prefer to buy bonds near par, which put them in lower coupon pools, from 2% – 3%, which were the same bonds that the Fed was buying at the time. As the FDIC works through these liquidations, it’s going to disproportionately pressure those lower coupon pools wider.

Q: Who do you think the buyers of that portfolio will be?

Brendan: The Fed and banks led the demand for MBS coming out of the pandemic, but both have pulled back with quantitative tightening and the rise in interest rates. This supply is ultimately going to be bought by money managers, who have already been absorbing flows from the Fed’s quantitative tightening over the past year. MBS spreads widened last year as money managers stepped in with the drop in demand from the Fed and banks and have remained pressured with this recent turmoil.

Q: Do you still see value in agency MBS?

Brendan: Yes, agency MBS valuations look attractive from a historical context, but it depends on how you are positioned within the space. Higher coupon pools, which outperformed lower coupons last year due to pressure from the Fed’s selling, continue to have a favorable technical outlook. The ongoing reduction of the Fed’s balance sheet and the FDIC’s liquidation of the failed banks’ holdings are likely to weigh on lower coupons, further driving the outperformance of higher-coupon pools. So while we remain constructive on the space, we believe it is important to be mindful of technical dynamics within it.

Q: What is your outlook for securitized assets for the rest of 2023?

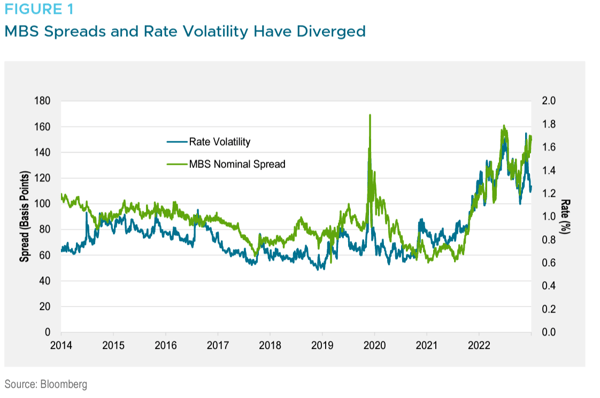

Brendan: Prior to the recent banking turmoil, the agency MBS sector’s technical environment had been improving. Higher mortgage rates pushed refinancing and purchase activity to multi-decade lows and slowed the pace of runoff from the Fed’s portfolio to less than half of the monthly cap, reducing overall supply to the market. Valuations look attractive, as spreads have retested the post-Covid wides that we saw in October of last year. A lot of that was brought on — then and now — by interest-rate volatility. From October to January the agency MBS sector posted two of its best months in terms of performance because interest-rate volatility came down as the Fed reduced the pace of rate hikes (Figure 1). Updated Fed guidance in February and the banking turmoil in March pushed interest-rate volatility back up to peak Covid-levels before retreating, with the resolution of the failed banks. MBS spreads are normally highly correlated with rate volatility; however, they’ve remained wide due to this overhang from the FDIC’s liquidation of the failed banks’ portfolios.

This unusual scenario has created an interesting opportunity — and an attractive point for long-term investors to buy MBS. Interest-rate volatility has started to come down and should shift lower if the Fed does ultimately pause and we get an orderly unwinding of the FDIC portfolio. Outside of the recent banking turmoil, which again, was not driven by poor credit quality of the assets held, but rather by rising interest rates, technicals look good, valuations are attractive, and we believe most of these FDIC sales are priced into the market.