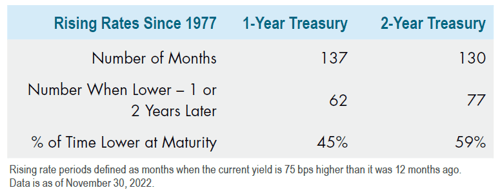

Reinvestment Risk Is a Coin Toss, with Higher Stakes Now - December 2022

The single most important component of a bond’s return over the long run is the reinvestment rate. A bond is a series of fixed cash flows, however these cash flows can be reinvested over time at different rates of return. Reinvesting these cash flows at higher yields will compound over time and ultimately lead to higher returns over the bond’s life. The principal typically represents less than 50% of a long-term bond’s return. With the coupon or income rate fixed, capturing higher yields in a rising rate environment can boost the interest component of a bond portfolio’s return. Logically, as interest rates rise, bonds should become that much more attractive to investors. Therefore, bond investors should welcome higher yields and the ability to lock in those yields for longer time periods by owning longer maturity bonds.

However, for the less experienced investor, making the tactical decision to shorten duration to preserve their principal in the face of higher interest rates has historically been successful only about 50% of the time. Unless the investor can time the market successfully every time, the prospects of shortening duration has succeeded roughly the same amount of choosing heads or tails in a coin toss. This is not a sound investment strategy when yields are higher and the reinvestment of bond interest compounds to a greater effective return.

Looking back through data since 1977, there are 137 months where investors could have bought a 1-year US Treasury after a rate rise of 75 basis points. Assuming the 1-year bond is purchased and held to maturity, the investor would have reinvested at a lower rate in 62 of those periods, or 45% of the time. For 2-year Treasuries, the investor would have reinvested at a lower rate 59% of the time. Their overall return would have actually declined as the bond matures and they were forced to reinvest at lower rates of return.

Consider the volatile nature of reinvestment rates

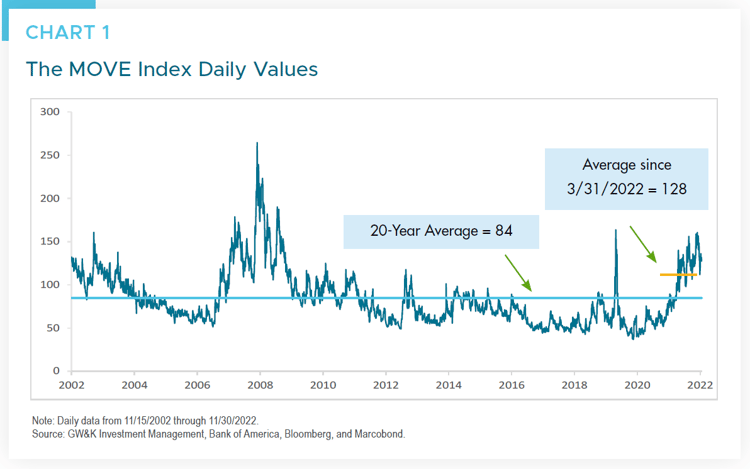

Shortening the investment duration of your bonds will require more frequent reinvestment. Doing so repeatedly means you have to be correct multiple times: at first purchase and then again at reinvestment. Assuming a 50% probability for a successful outcome for each decision and multiplying by the number of decisions, you can see how the probability for continued success declines rapidly. Moreover, the biggest challenge with this is the volatility associated with interest rates. The Merrill Lynch Option Volatility Estimate index (MOVE Index) tracks the volatility of one-month over the counter options on 2-year, 5-year, 10-year and 30-year Treasuries. Considered the “VIX1 for bonds” by some, the MOVE Index average value over the last 20 years is 84.5, as seen in Chart 1 below.

Between March 24 and November 30, 2022, the index has averaged 128.3, which is over a 50% premium to the long-term average! In addition, when compared to other asset classes since June 2022, the MOVE Index is significantly higher than equities (as measured by the VIX), crude oil (as measured by OVX2), and currencies (as measured by Deutsche Bank’s Currency Volatility Index (CVIX)).

1The Chicago Board Options Exchange’s Volatility Index (VIX) measures the stock market’s expectation of volatility based on S&P 500 Index options. It is often referred to as “the fear index.”

2The Chicago Board Options Exchange’s Crude Oil ETF Volatility Index (OVX) estimated the expected 30-day volatility of crude oil as priced by the US Oil Fund.