GW&K Global Perspectives — June 2024

The US Housing Market Weathers High Mortgage Rates

Highlights:

- The housing market has remained resilient despite high mortgage rates, supported by limited supply and strong demographic demand.

- Most homeowners have mortgages well below current rates, creating pent-up supply and demand that could rebound if rates decline.

- High mortgage rates remain a risk to affordability, but resolution of monetary policy uncertainty could provide relief.

The Housing Market's Surprising Strength

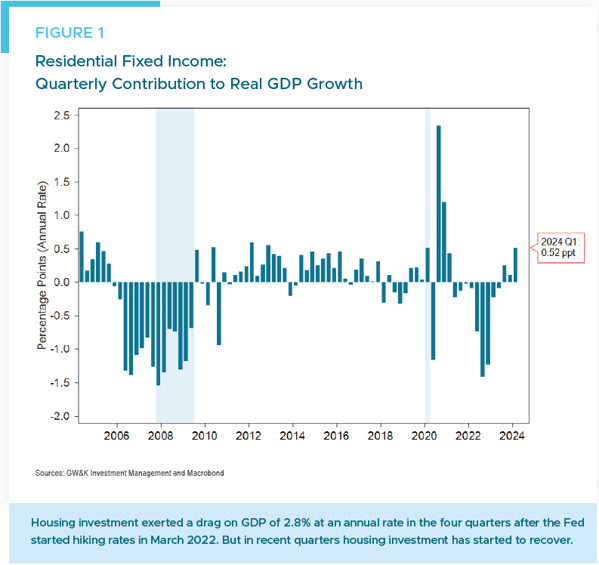

The US housing market has held up remarkably well in the face of the sharpest rise in interest rates in 40 years. While housing indicators initially dropped in response to higher rates, residential fixed investment has been recovering in the past three quarters (Figure 1). A combination of factors help explain housing’s resilience.

Tight Housing Supply

A key reason the housing market has remained firm is the lack of supply. Vacancy rates for owner occupied homes are near 50-year lows, reflecting a scarcity of available houses (Figure 2). The inventory of homes for sale, while up from pandemic lows, also remains constrained (Figure 3). This tight supply has prevented a major decline in prices as buyers bid for the limited number of homes. The Case-Shiller US Home Price Index has even started to recover, rising 6.4% in February from a year earlier (Figure 4).

Demographic Trends Fuel Demand

Demographic forces have also bolstered demand while limiting supply. Millennials, buoyed by stimulus checks and taking advantage of low rates before the recent hikes, entered the market in large numbers. With tens of millions of Millennials nearing the peak home-buying age of 33, their presence should sustain demand and absorb inventory (Figure 5). At the same time, older Baby Boomers, who own a large share of homes, have been hesitant to sell, further limiting supply.

The recent jump in immigration has also significantly boosted housing demand (Figure 6). The Congressional Budget Office estimates immigration is currently adding about 3.3 million people to the US population each year, over three times the pace of the previous decade.1 Even assuming larger household sizes for immigrant families, this likely translates to demand for at least 500,000 additional housing units annually.2

Locked-In Homeowners Create Pent-Up Supply and Demand

The surge in mortgage rates from record lows to over 7% means the vast majority of homeowners now have loans well below current rates (Figure 7). In fact, nearly 70% of borrowers have mortgages at least 3 percentage points below prevailing levels. This creates a strong disincentive to sell and buy a new home at much higher rates.

As a result, the lock-in effect has caused a sharp reduction in home sales and new listings. The Federal Housing Finance Agency estimates 1.3 million home sales were lost due to this phenomenon since March 2022.3 Empirical Research Partners suggests the cumulative drop in sales versus the prepandemic trend could be as high as 2 million, while new listings have fallen by about 1.9 million.4

This has important implications for housing and related sectors. The pent-up supply from the lock-in effect could lead to a surge in listings if mortgage rates fell substantially, pressuring prices. However, Empirical’s analysis suggests demand would likely rebound even more than supply in this scenario, supporting prices. A drop in mortgage rates to 5.5% could boost sales by 20% – 25%, while listings would rise a more modest 15% – 20%.

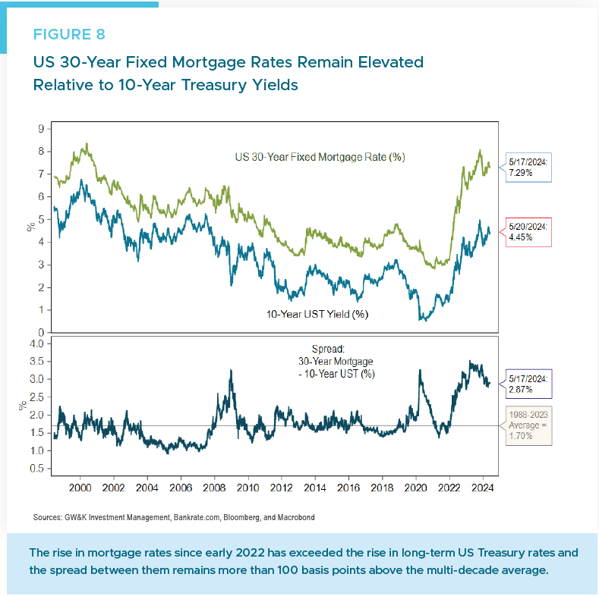

Mortgage Rates Remain High Versus Treasuries

Mortgage rates play a critical role in housing affordability and will be key to the market’s future as the Fed tries to tame inflation without derailing growth. Notably, the spread between mortgage rates and Treasury yields remains quite high, as lenders demand extra compensation for risk and uncertainty (Figure 8). This means even small shifts in monetary policy could have an outsized impact on mortgage rates and affordability. For now, high home prices and mortgage rates have made home buying conditions among the worst on record (Figures 9 and 10). Declining mortgage rates would significantly improve affordability.

Conclusion: Opportunities Amid Challenges

Amidst these challenges, builders and investors have found ways to adapt. Large homebuilders have gained share by offering incentives and adjusting home sizes and prices to maintain demand. Building-product suppliers with strong distribution relationships have benefited from stabilizing construction.

Meanwhile, investors have taken advantage of robust rental demand and attractive economics in the single-family rental market. Stable home prices and potential for appreciation have made this an appealing segment. Large institutional buyers have created a new source of demand that may have squeezed out individual home buyers, perhaps creating a political issue for the current and/or future administrations.5

Going forward, the housing outlook remains stable — but with risks and opportunities. Sustained high mortgage rates could further dent affordability, especially for first-time buyers. However, any resolution of monetary policy uncertainty leading to lower mortgage spreads could provide relief. Mortgage-backed securities investors could see prices rise in two ways as spreads and yields decline. The market’s resilience could be tested if job losses sap demand, but limited supply and demographics suggest housing can weather these challenges.

William P. Sterling, Ph.D.

Global Strategist

1 Congressional Budget Office, “The Demographic Outlook: 2024 to 2054,” January 18, 2024.

2 Michael Feroli, “US: The Economic Effects of Surging Immigration, JP Morgan North American Economic Research, March 19, 2024.

3 Ross M. Batzer, et al, “The Lock-In Effect of Rising Mortgage Rates,” Federal Housing Finance Agency, Working Paper 24-03 (March 2024).

4 Laura Dix and Sean Duncan, “The Interest-Rate Lock-In Effect: Sizing Housing’s Pent-Up Supply and Demand, Empirical Research Partners, April 5, 2024.

5 Daniel Herriges, “Going After Corporate Homebuyers Is Good Politics But Ineffective Policy,” Strong Homes, February 18, 2024.