Ubiquitous Apps, NEVs, Hesitant Consumers, and Domestic Champions: Research Notes from China

Equity Research Analyst Matthew Clemmer recently returned from his first post-Covid investment research trip to China. What he saw there Reinforced his belief that China’s recovery, while well underway, will likely be uneven and slower than initially anticipated when pandemic Restrictions were lifted. Here he shares more about what he experienced in Asia and what he learned from company management teams during his visit.

Highlights:

- Despite a slower-than-hoped-for post-Covid recovery, Chinese equities offer active, bottom-up investors interesting opportunities today.

- Issues with the real estate market, local government financing, and youth unemployment are the biggest challenges facing China.

- In many sectors, domestic Chinese brands have narrowed the quality gap and are taking market share from long-established foreign brands — including autos, where domestic new energy vehicles are edging out the competition.

Q: What were you most surprised to see in China on your first trip there since 2019?

Matt Clemmer: A lot has changed in three and a half years, and there are some visible scars of Covid, which have manifested in many ways. The lockdowns impacted people differently. For instance, some people may have had to close their business or otherwise had their earnings power reduced. These experiences impact their current attitudes toward spending.

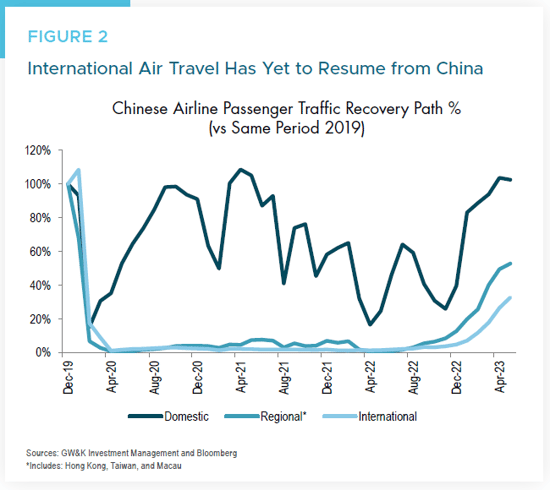

International travel from China continues to carry obvious scars of Covid, and these are most visible in large, international airports. Before Covid, international travel played an important role in supporting regional consumption.

At the same time, in some ways it felt like not much had changed at all. China has become much more convenient to get around, thanks to the amount of infrastructure that has been built over the last 12 years, which makes it much easier to travel from megacity to megacity by high-speed rail. It’s very efficient, and just something that we don’t have the luxury of here in the United States. Traveling at 300 kilometers an hour (the equivalent of 186 miles per hour) is very fast!

Cash Is No Longer King

Perhaps the most obvious thing I noticed right off the plane was how ubiquitous WeChat Pay and Alipay have become in people’s lives. I’ve read a lot about this, experienced it before Covid, and have seen the data on it, but nothing prepared me for what it actually felt like to be a visitor in this nearly cashless society. Almost daily, it felt debilitating not to have the same access to order or pay for things. It made me realize that during the entire three and a half years I was away, technological development and consumer technology penetration had been, and are still, running at 100 miles per hour. As a visitor, I had access to a lighter version of the indigenous apps. While those remain in development, tech moves fast. Just the other day, the two leading payment applications announced that they will begin opening their systems to foreign credit cards in a more meaningful way. I am already looking forward to paying like a local on my next trip.

New Energy Vehicles and the Rise of the Domestic Brands

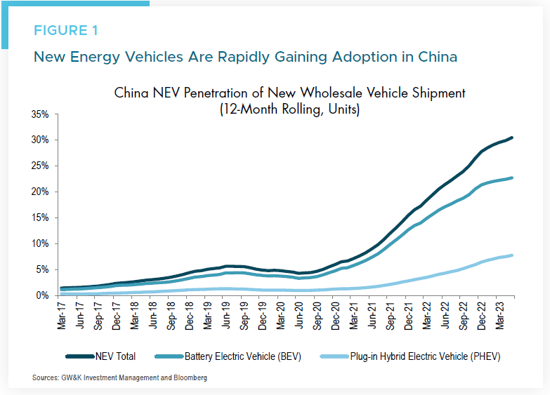

The other, almost tectonic, change is the shift to new energy vehicles (NEVs), both plugin hybrids and pure battery-powered vehicles. It’s not just the number of these vehicles on the road that was incredible to see — and they are easy to spot because they have green license plates instead of the traditional blue ones — but also the number of Chinese domestic car brands and models. It was staggering to see the amount of market share that has been taken away from foreign joint-venture car makers, especially of the combustion engine variety, and shifted to the NEVs that, except for Tesla, are now largely domestic brands. Again, I see this data monthly, but to see it on the road and in the auto showrooms in shopping malls is incredible (Figure 1).

In November of 2020, the foreign joint-venture share of automobiles was about 70%; that has come down to around 50%, and even less if you take Tesla out of the equation, since local production was just getting started in China in 2020. The countries that have lost the most share were the leaders, such as Germany and Japan. If I were a car executive from one of those countries on my first trip to China since Covid, I think I would have left the Shanghai Auto Show in March a bit fearful of the future.

Some of the most interesting interactions I had during my trip happened while speaking to domestic-brand salespeople, who were excited to share information about the cars they were selling. It’s true that older cars made by the domestic Chinese brands weren’t always of the highest quality. They were relatively less expensive, but there was a reason foreign brands dominated the market. Today, the new NEVs are high-quality, equipped with cutting-edge technology, with competitive price points.

In some large cities such as Shanghai or Beijing, one incentive for people to choose an NEV over a traditional gas-powered car is that NEV owners can receive a free plate registration. In Shanghai, this could mean a savings of RMB 92,000 (about USD 13,000).

Q: How is the recovery going in China?

A Slower, Uneven Recovery

Matt: The recovery is happening for some things, in some places, some of the time, rather than for all things, everywhere, all at once. The meetings I had with Consumer Discretionary companies pointed to continued growth for 2023 — albeit at a reduced level than originally anticipated. Several consumer companies I met with that were initially targeting 15% – 20% top-line growth have now revised that down to 10% – 15% growth. If you adjust for the Covid impact in 2022, this is more like 8% – 12% organic growth.

A popular quick-service restaurant company I spent time with shared that demand post-Covid has returned at weekends and holidays, but spending is slower mid-week, so they are relying on mid-week promotions to drive traffic and increase sales volumes. A meeting with a leading Chinese skincare and cosmetics company revealed that they believe that they are benefitting from consumers trading down from some Western skincare brands within the “masstige” space.

Per Capita Spending Remains Challenging

So, while the consumer is showing up, per capita spending remains challenging. The data following the Chinese Labor Day holiday in early May showed that traffic was up 19% of what it was in 2019, while spending was only up 1%. Some of the industrial company management teams I met with also confirmed that consumers are not spending the same way they did pre-Covid — or in 2021. We do believe that the consumer has more that they can do, they just have to come out and do it.

There are two more national holidays coming this year when people traditionally spend and travel, the Mid-Autumn Festival and National Day. I think these two holidays will provide a good marker of whether consumption per capita will pick up in 2024. Additionally, the holidays will provide insights into international travel as regional airlines should enter more capacity into service leading up to these holidays.

Domestic travel has come back strongly, but as I alluded to earlier, international travel in Asia is lagging the Western hemisphere (Figure 2). Historically, Chinese tourists have been a key driver for international tourism in the region. Thailand is a good example: Chinese nationals made up nearly 30% of Thailand’s international arrivals pre-Covid. Currently this percentage is in the low-double digits, but increasing. Japan and Korea are similar in that Chinese tourists are critical to reaching pre-Covid international arrival numbers.

When I traveled through Shanghai Pudong Airport, it was eerily quiet in the international terminals, and many stores and restaurants remain shuttered. Taipei in Taiwan is better, and Incheon in Seoul, South Korea is even better. But even in those places, not all the services, like food vendors, have come back. It will take time, but in Pudong it was incredibly low. In Seoul, the duty-free malls that in the past were bustling with Chinese tourists and Chinese resellers had only a fraction of the customers. I did see one lonely Chinese live streamer there who was enthusiastically introducing various shades of red lipstick.

Q: Are Chinese consumers just saving their money post-Covid? What do you think would encourage them to spend it?

Matt: That’s the million-dollar question. Pundits believe there are excess savings from the last two years, but it is unclear how large and “disposable” these savings will be. Some people have a general insecurity regarding their future and near-term earnings potential, and obviously these concerns may cause people to save more. I think there is a direct correlation between how traumatic an individual’s Covid experience was, be it lockdown or loss, and how willing they are to spend now. And unlike some other countries, China’s Central Government has not historically approached demand-side stimulus with cash handouts. They may provide subsidies for purchases like new cars or white goods instead, which also helps the employment base. We have seen some cities and provinces execute vouchers to help stimulate consumption, but not really at the Central Government level.

We are seeing continued growth in certain areas such as European luxury bags and domestic travel, but we are still waiting for spending to come back during “quiet periods”, such as mid-week or post-holiday. As an example, having 90% hotel occupancy on Friday and Saturday is great, but we want to see that during the week too. My conversations with taxi drivers and store and restaurant owners confirmed this post-holiday hangover and corresponding disappointment.

But remember, the likelihood of a recession in China is low, perhaps 10%. What we’re seeing on the consumer side is more of a growth recession. At the company level, there is still double-digit organic growth; it just doesn’t feel as good as we had hoped at the beginning of this year. I think addressing the tepid consumer will come more from the overall employment environment firming up, which can be helped by the manufacturing and real estate industries improving.

Q: What are the biggest challenges to China's economy now?

Real Estate

Matt: Real estate is in a tough spot because of a government policy decision to try and address previous years of excessive investment and speculation. Like a lot of major economies, real estate, housing, and construction are a significant part of the economy and can be a big growth driver or a decelerator. In this case, over the last 16 – 18 months, it’s been a headwind to growth.

Local Government Financing

There are also issues with local government financing, regarding debt that has been incurred by certain provinces over the last 12 years to fuel things like infrastructure. There is no doubt that investment in infrastructure is key to China’s success and future; however, there are some provinces that used debt to fund infrastructure projects that may not have provided the same economic benefits as other investments. If local governments need to deleverage, it means they will have to grow GDP away from infrastructure, reduce spending, or a combination of both (if GDP is being used as a proxy for provincial income).

Historically, land sales for real estate projects were a local government’s key revenue source. With real estate demand slowing down, jurisdictions which relied heavily on land sales will have a more difficult time reducing their leverage ratios. In some respects, the Central Government has taken the punch bowl away and is requiring certain provinces to sober up. This is not happening across the entire country, and it may be more of a city-level problem that could become a provincial-level issue.

The Central Government has a stated agenda of rebalancing economic growth away from infrastructure toward more consumption. Whether measures put in place in the past several years are sufficient to accomplish this agenda remain to be seen. In my opinion, the challenges facing real estate and local government financing are intended consequences of addressing years of excessive investment and debt buildup. We are witnessing the Central Government’s approach to a controlled burn, with the intended result being a rebalanced economy for healthier growth going forward.

Youth Unemployment

Youth unemployment is also a known concern. The unemployment rate is over 20% for workers aged 15 – 24. It is worth noting that some of the sequential change in youth unemployment feels a bit seasonal, and we are likely to see the numbers improve after this recruiting season.

Q: What are the most encouraging things you're seeing in China from an investing perspective?

Domestic Champions

Matt: The emergence of domestic champions in China is really encouraging, and this extends beyond NEVs and consumer technology. I had meetings with great companies from a wide range of industries, such as industrial automation and machinery.

Within the industrial automation space, there is a company that started out making inverters for elevators that has now grown to also produce servo motors, programmable logic controllers, and industrial robots — all key components for industrial automation. Over a 12-year period, they’ve grown to be the number one supplier in China for servo motors, a spot which has historically been occupied by foreign equipment manufacturers. The company’s supply chain is largely onshore, and Covid certainly helped it take more market share. The supply-chain issues some multinational companies faced were not felt by this company in the same way, and this company really took advantage of the opportunity to fulfill orders and widen their customer base.

Inventive Marketing

Another example is a domestic cosmetics company. This company initially launched products that targeted teenagers and college students who were looking for more affordable alternatives. As their customer base aged and began to earn more money, product expectations increased and the company responded by raising the quality of the products, packaging, and active ingredients, which pushed price points higher. Now they’ve moved more into the masstige space that was historically dominated by foreign brands. This company is expected to grow its top line more than 30% against the backdrop of a challenging consumer spending environment.

While visiting this company’s headquarters, I saw about 25 small rooms for online live streamers, who work in shifts to put out content for this brand 20+ hours a day. They are educating their customers and reaching them where they are online, not at a traditional cosmetics counter. I’d heard about this marketing initiative in virtual meetings during the pandemic, but to see it in-person was incredible. It’s not too different from the home shopping network, but faster, younger, and pushing a single company’s products.

Improved Product Quality

What has changed in China — and this is not by chance, this is by design — is some domestic companies’ product quality. The movement up the technology, quality, and value curve has massively improved. Again, not everywhere, all at once, all the time, but certain domestic companies have narrowed the quality gap against international competitors in a meaningful way. I’m not talking about low-end, low-quality manufacturers, but rather the companies making products that are replacing foreign brands in China. This is thanks to years of investment in research and development, human capital, and supply chain improvements.

Premier foreign brands remain highly sought after across many industries. But in some areas, we’re seeing domestic substitution — although these are typically single champions in their respective industry or category, not a group of champions for each industry or sector. There will continue to be room for the foreign leaders, but some second-tier foreign players are already being squeezed out.

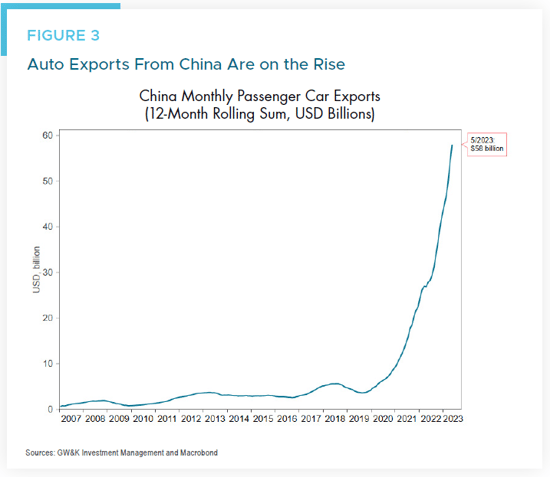

Whether the rise of domestic champions can translate outside the country is yet to be seen. Many years ago China became the largest new car market in the world. This was driven by domestic consumption and supported by foreign joint ventures. However, the Chinese export story is largely new and, while foreign brands such as Tesla contribute to the export volumes, the domestic branded volumes are increasing as well. China is exporting more cars than it ever has (Figure 3) — an estimated 4 million vehicles this year. China long ago surpassed the US and Japan combined in terms of auto production. This year China moved ahead of Germany and Japan to become the world’s largest auto exporter of automobiles. This may be an early sign of things to come in value-added products in multiple industries in the future.

Several other countries have gone through the product quality evolution that China is going through right now. For example, US consumers had a much different perception of the quality of South Korea autos in the early-2000s than they do today. Will politics allow other countries to see China on the global stage the same way they see South Korea or Japan? That may be an open question for the United States for now, but I think China will find market opportunities for their vehicles quickly in Australia, which is really an “import-only” market for passenger vehicles, Southeast Asia, and Eastern Europe.

My career as an emerging markets analyst has moved in tandem with these developments, so it is very interesting, and encouraging, to see these initiatives coming to fruition.

Q: Any final thoughts?

Matt: The trip underscored the value of visiting with consumers and businesses as opposed to just reading reports. Much of my trip involved informal discussions that provided a deeper understanding of what post-Covid China looks like. Signs of progress were everywhere in terms of the move to cashless, new energy vehicle penetration, domestic brand perception, high-speed travel, and industrial development.

For reasons we discussed, China is not yet experiencing the reopening bounce that was anticipated. Being on the ground, the delayed response is understandable, given the overhang of revolving lockdowns, Covid uncertainty, and the headwinds from years of excessive real estate development. Is the recovery delayed or were hopes of a material recovery misplaced? My view is that the recovery is delayed, and Mid-Autumn Festival and National Day will provide the next datapoints to test any progress.