GW&K Global Perspectives — March 2023

China's Great Reopening: Opportunities and Risks

Highlights:

- China has ended its Covid restrictions with astonishing speed and the economy is already recovering rapidly. This major development presents both opportunities and risks for investors.

- Opportunities include stronger Asian growth and revenue gains for selected US firms with large sales to China. Chinese stocks should also benefit from rebounding earnings and valuations.

- Key risks are whether China’s reopening will put upward pressure on global manufacturing goods prices or energy prices. Oil prices remained subdued for now but bear close watching.

China's Reopening Recovery Is Underway

After nearly three years of rolling lockdowns, China has ended its Covid restrictions faster than any other country. In weeks, it has scrapped its main tracking app, ended harsh quarantine measures and criminal penalties, and welcomed foreign visitors without quarantine. The shift from zero-Covid to living with the virus is stark.

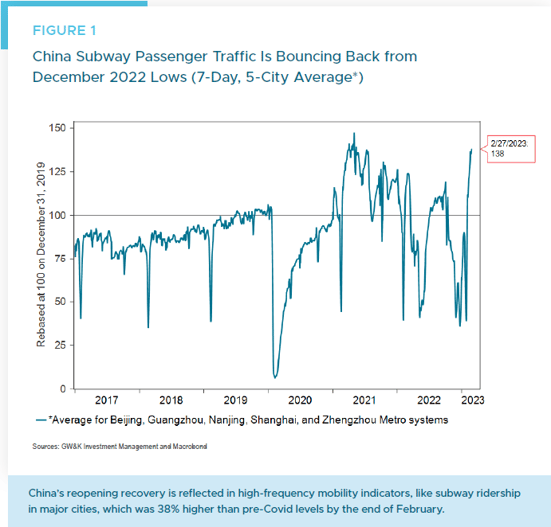

The economy has responded strongly. Mobility indicators have bounced back since early 2023 (Figure 1). Hotel occupancy during the Lunar New Year holiday returned to pre-pandemic levels, and hotel stays were more expensive. Compared to 2022, air travel increased by a third in January.

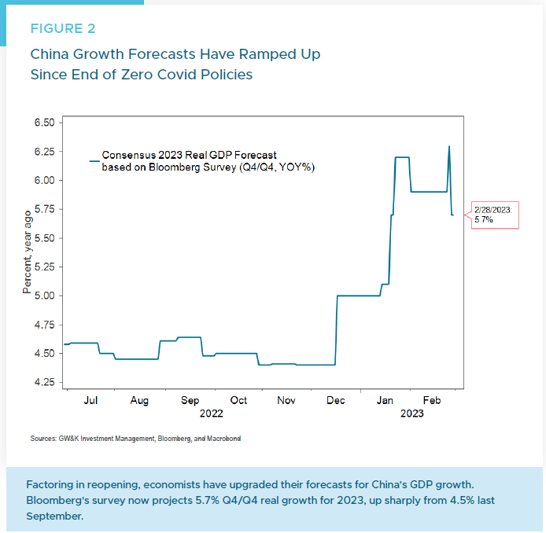

Official data confirms the rapid recovery. The official Purchasing Managers Indexes for both January and February were much higher than expected. Notably, the February numbers for both manufacturing and services are among the strongest in a decade. Economists have upgraded their forecasts for China’s GDP growth in 2023. Bloomberg’s survey now expects a 5.7% year-on-year rate in the fourth quarter, up from 4.5% last September (Figure 2). The IMF has also raised its projection for China’s growth in 2023 to 5.2%, from 4.4% in October.1

China has lured foreign capital, as investors see a brighter outlook and seek exposure to its markets. The country’s reopening is potentially one of the most important macroeconomic developments of 2023. As always, big economic developments can create both opportunities and risks for investors.

Opportunities: Stronger Asian Growth and Revenue Gains for Select US Firms

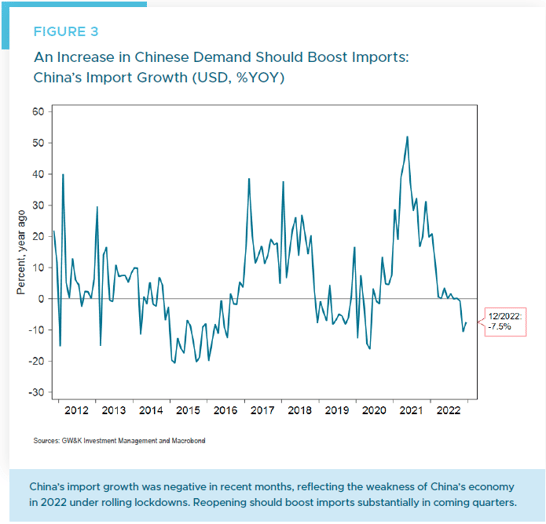

China’s reopening will reshape Asia’s economy. Its imports fell sharply because of Covid lockdowns that disrupted supply chains (Figure 3). We expect a rebound as restrictions are further relaxed and demand recovers. Vietnam, Taiwan, Malaysia, and Singapore will benefit most from this revival: they export consumer electronics, food products, textiles, and cosmetics to China worth 6% – 9% of their GDP.

Tourism and education sectors in Asia outside of China will also likely feel a boost. Chinese tourists spent lavishly in Asia before the pandemic: In 2019 Chinese tourists accounted for 6% of Hong Kong’s GDP, 3% of Thailand’s and 1% of Singapore’s. Thailand and Hong Kong will welcome them back eagerly, particularly in leisure and gaming. As will Singapore, which has a strong reputation for overseas education among Chinese students.

It should be noted that US exports to China account for less than 1% of America’s GDP. But some American firms, such as Wynn Resorts, Apple, and Caterpillar, rely heavily on sales to China. These firms stand to gain from China’s rebounding growth, to the extent rising trade and diplomatic tensions between the two countries don’t create another hurdle.

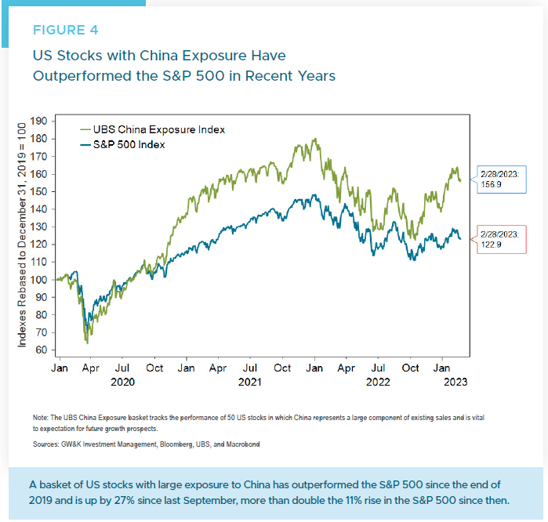

Investors have lately rewarded such firms. The UBS China Exposure Basket, a group of 50 American stocks with large sales to China, has surged by 27% since last September — outpacing the 11% rise of the S&P 500 over the same period (Figure 4).

Opportunities: Rebounding Chinese Earnings and Valuations

Foreign investors are returning to China’s stock market. In January they bought a net $21 billion worth of domestic shares, a record monthly high since 2017. The MSCI China Index, which tracks Chinese firms listed at home and abroad, has soared by 37% since October. The CSI 300 Index, which covers mainland-listed firms, has risen by 16% over the same period.

The rally has two main drivers: earnings and valuations. China’s economy is recovering from the pandemic, boosting corporate profits. GW&K’s Emerging Wealth Equity Portfolio Managers, Tom Masi and Nuno Fernandes expect net profit margins to bounce back smartly as demand picks up.2 The net profit margin for the MSCI China Index recently fell to 8.2%, well below its two-decade average of 11.4%. That suggests ample room for profits to rebound along with the economy.

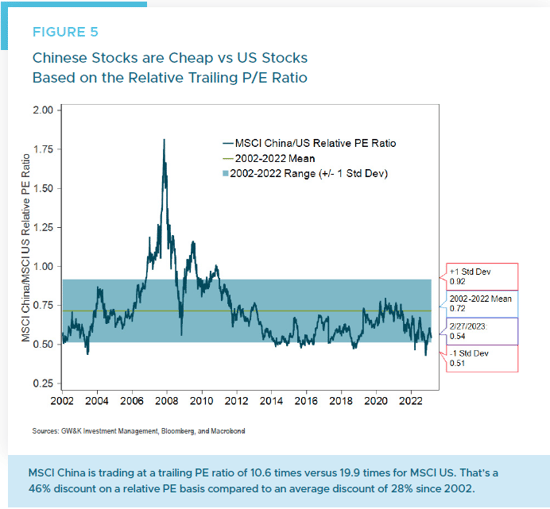

Meanwhile, Chinese stocks look cheap relative to US stocks. The MSCI China Index trades at 10.6 times its trailing earnings, a 46% discount to the MSCI USA Index (Figure 5). That gap is wider than the historical average of 28%. If Chinese firms can narrow their profitability gap with American ones, and if investors assign them higher valuations, Chinese stocks could deliver hefty returns.

Tom and Nuno call attention to risks such as trade tensions, a Taiwan conflict, a property crisis, and government meddling.2 But global equity investors seem wary of these risks. According to data from J.P. Morgan, emerging market (EM) equities make up only 6% out of their collective $24.8 trillion in assets. This is well below EMs’ 11.1% share of global market capitalization.3 China, which represents roughly a third of the MSCI EM Index, suffers a $400 billion underweight because of this. That degree of cautious positioning leaves room for optimism — if China can avoid major trouble.

A growing concern is that China aids Russia’s invasion of Ukraine, which would trigger harsh sanctions from the US and Europe. Financial markets are apparently not too worried about that scenario given the outperformance of US stocks with China exposure noted above.

Risks: Will China Export Inflation?

As the world emerges from the Covid-19 pandemic, the persistence of inflation has become an increasingly prominent concern. One major question is whether China’s post-Covid reopening will export inflation to the rest of the world. There are two main issues to consider.

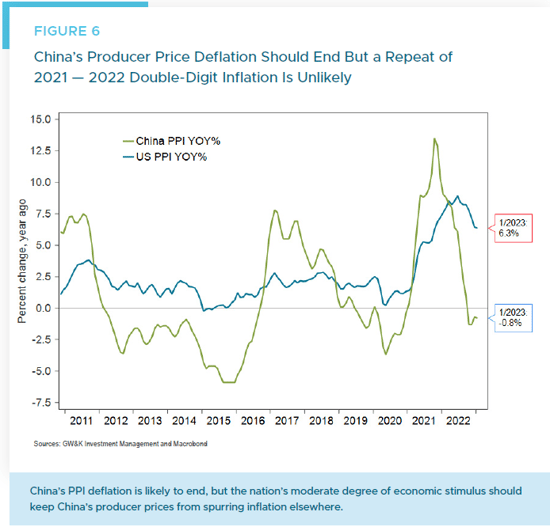

The first is the potential impact on China’s domestic inflation. China’s manufacturing sector accounts for around 30% of global manufacturing, so any upstream pricing pressures in China could quickly be mirrored in other markets that depend on Chinese suppliers (Figure 6). However, there are several reasons to think that China’s post-Covid reopening may not lead to significant inflationary pressures. China’s PPI is currently declining about 1% year-on-year, and Bloomberg’s survey of economists expects an increase of only 1.7% for 2023 overall.

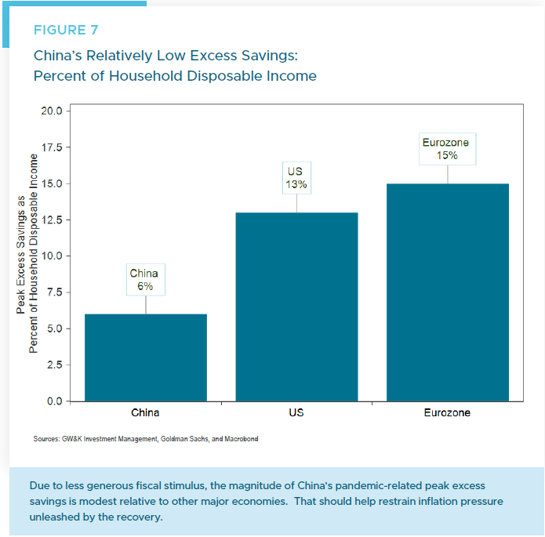

Moreover, the degree of excess savings in China that could trigger inflation is much more muted than in other major economies. Goldman Sachs estimates that China’s excess savings are approximately 6% of household disposable income, compared to peaks of 13% and 15% respectively in the US and the Eurozone during the pandemic, due to more generous fiscal transfers to households and businesses in those latter areas (Figure 7).

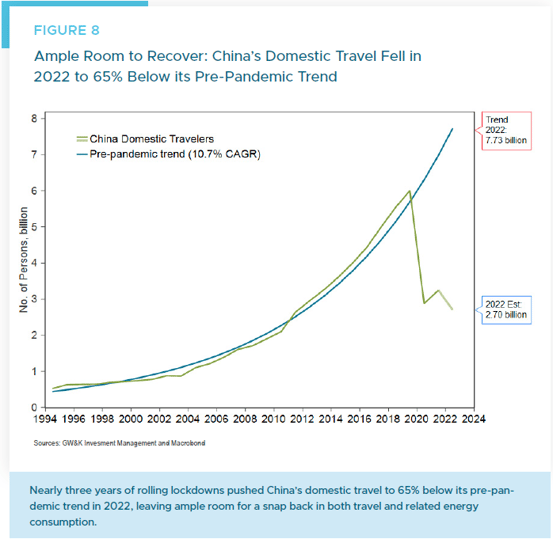

The second major issue is the potential impact of China’s reopening on global energy prices. With domestic travel still 65% below pre-pandemic levels, there is ample room for recovery as consumer behavior normalizes (Figure 8). Additionally, China’s oil imports were 21% below their pre-pandemic trend at the end of 2022, suggesting the potential for a snapback in demand.

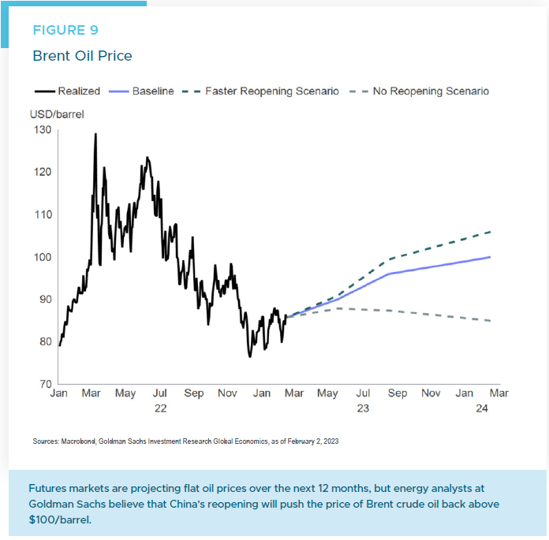

The International Energy Agency (IEA) forecasts that China’s reopening could boost global oil demand by 2 million barrels per day in 2023 versus the prior year.4 As a result, the IEA raised its global oil demand forecast for 2023 to 101.9 million barrels per day. However, some energy experts predict considerably more upside for oil prices due to China’s rebound (Figure 9).

Futures markets imply Brent crude oil will end the year at $80 a barrel. If upward pressure on energy prices materializes, it could be a complicating factor for major developed market central banks who have prioritized fighting inflation. Nevertheless, the evidence suggests that the risks of inflation from China’s post-Covid reopening may be more muted than some have feared.

Ultimately, the development of recessions in the US and Eurozone in response to tight monetary policy will heavily influence global energy prices. This may offset the impact of China’s recovery. Regardless, China’s reopening marks a critical milestone in the global economy’s return to normalcy after the pandemic.

William P. Sterling, Ph.D.

Global Strategist

1 Eric Martin, “IMF Eyes ‘Turning Point’ for World Economy as Growth Bottoms,” Bloomberg News, January 31, 2023.

2 Tom Masi and Nuno Fernandes, “Considerable Upside Potential for China Equities Warrants Exposure,” GW&K Investment Management, Emerging Wealth Insights, January 2023.

3 Janik Mody, “EM Inflows Losing Steam, Active Inflows Sustain,” EM Money Trail, J.P. Morgan Global Research, February 17, 2023.

4 Grant Smith, “IEA Boosts Global Demand Forecast as China’s Economy Reopens,” Bloomberg News, February 15